Queltex Ai is the gateway that connects individuals to investment tutors. First, individuals sign up for free. Then, we match them to an appropriate investment education firm based on their selected preferences. They get their unique login details from there and can start learning immediately.

Individuals can learn basic investment concepts and more from scratch by signing up for an investment education. They study how to navigate investment risks and employ the necessary tactics in line with their financial objectives. Queltex Ai is free. Sign up to connect to a suitable education firm.

The fresh knowledge is the best part about being a first-timer at anything. It's like the opening of a new world. The same goes for investing. Those who have no idea what it entails are welcome to match with tutors who specialize in teaching beginners. They start with the fundamentals and work their way up.

Some people try their hands at investing on their own. Just to get a feel of how things work. They are inquisitive individuals.

Moving forward with curiosity means taking the step to learn how investments truly work. Queltex Ai is the gateway to investment literacy.

Individuals who have been investing for years are the MVPs. They know and have played the investment game in time. However, they know the value of knowledge.

The investment world evolves daily. Experts need to keep up with the times. Connect with a suitable tutor with Queltex Ai.

Register with Queltex Ai in a matter of minutes. Signing up requires only a few details.

Registration immediately triggers the connection to a suitable education firm. Users are assigned a firm for personalized investment education.

After confirming the firm, a rep is assigned to each user. The reps are responsible for onboarding users to begin their educational journey.

Queltex Ai does the hard work. Individuals who are ready to learn only need to sign up to match with an appropriate firm. We'll take it from there. Investing is a skill that can be learned. Queltex Ai encourages individuals from all walks of life to embrace financial education.

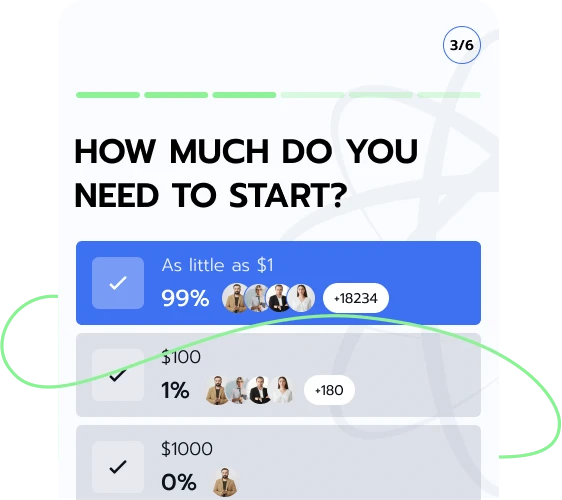

Queltex Ai embraces diversity. We do not discriminate. Anyone ready to learn will match with a tutor. Background and budget size are not hurdles here. Queltex Ai caters to different budget sizes, so there is a fitting investment tutor for every individual. Sign up for free to match with a suitable education firm.

Queltex Ai offers multilingual services that cater to a diverse audience. We ensure that language barriers do not exist between eager learners and investment literacy. Our commitment to inclusivity means individuals can learn how to invest in the language they are most comfortable with.

The only needed requirement to sign up with Queltex Ai is the willingness to learn. It is the most important requirement because no one can make anyone do anything beyond signing up. It falls to each individual to take their education seriously. Eagerness to learn is a good quality to have.

Investing Can Be Exciting

The thrills of seeing charts and numbers go up and down with real money at stake is an onus of investors.

Investing Is Risky

Nobody invests their hard-earned money without having it somewhere behind their minds that they may lose it.

Investing Can Be Learned

Fortunately, investing is a skill that can be learned if one is determined.

We play our role by connecting ready-to-learn individuals with fitting investment tutors who are ready to teach. Investing after learning may be a better idea than learning after investing. Sign up on Queltex Ai for free.

Rome wasn't built in a day. The journey to understanding investments will take a little time, too. However, the first step is what matters most. That is connecting directly to a tutor who understands the struggles of a beginner. Queltex Ai is the bridge to investment literacy. We do the matching so users can go straight to learning. Sign up for free.

Government policies also play a crucial role in the economic landscape. For example, fiscal policies involve government spending and taxation decisions. Monetary policies, on the other hand, control the money supply and interest rates. These policies are enforced in a bid to stabilize the economy and manage inflation. Sign up with Queltex Ai to connect with a tutor who can further break down the economic landscape.

Another key player in the economic landscape is the advent of global events. Natural disasters, geopolitical developments, and technological advancements can also influence the economic landscape. Investors who understand these dynamics know their importance when making their decisions.

An investment is allocating resources into an asset to capitalize on conditions that can affect its value. People invest their time and money. The primary goal of investing is to increase value over time. There are various forms of investments. Examples include buying stocks, paying for that online course, or running a business.

Investments are essential for long-term financial planning. Seasoned investors strategically place resources into assets they think will appreciate over time. Informed investing requires the ability to understand market trends and evaluate risks. Start learning with Queltex Ai.

Stocks represent ownership shares in a company. Investors buy stocks to try and gain from a company's capital appreciation and dividends. However, stocks are susceptible to market risks. Examples include price volatility and economic downturns. Company-specific risks may also affect stock value.

Bonds are debt securities governments or corporations issue in a bid to raise capital. People who invest in bonds may receive regular interest payments and their principal at maturity. Bonds are usually associated with low-risk investments. However, they may be susceptible to interest rate, credit, and inflation risks.

Real estate involves using property to seek rental income or capital appreciation. Examples of real estate investments include leasing an apartment building, warehouse space, or more types of properties. Factors like market fluctuations and property depreciation may affect real estate values.

Mutual funds pool money from multiple investors to invest in a diversified portfolio. Diversification offers a way to mitigate risk. However, mutual funds are still subject to market and management risk. Sign up with Queltex Ai to learn more about investment types.

Informed investors conduct their research and risk assessment before making an investment decision. There are various investment methods. Some are more risky than others. An educated investor knows which strategy to apply for each scenario. Learn more via Queltex Ai.

Tech has enabled the creation of online investment platforms and mobile apps that provide access to financial markets. This allows investors to trade from anywhere, which, in turn, has increased how people invest.

Technological advancements like artificial intelligence can analyze vast amounts of data at a go. Informed investors use the analyzed data to identify trends and predict market movements.

Financial metrics are quantitative measures used to track a business's performance. Examples of financial metrics include revenue, net income, and debt-to-equity ratio. Investors use financial metrics to get insights into profitability, efficiency, and liquidity. Sign up for free with Queltex Ai to learn more about financial metrics.

Revenue represents a business's total income from its goods or services sales before deducting any expenses. Revenue indicates a company's ability to generate sales. Investors consider this a key indicator of growth.

Net income is the amount remaining after all expenses, taxes, and costs have been removed from total revenue. Net income reflects the company's financial health.

Return on Investment measures the gain or loss generated on an investment relative to its cost. Investors use R.O.I. to assess the performance of an investment.

This ratio compares a company's total liabilities to shareholder equity. This indicates the extent to which a company finances its operations through debt versus wholly owned funds.

Gross margin is the percentage of revenue that exceeds the cost of goods sold. Investors use this metric to measure how efficiently a company produces and sells its goods.

The current ratio is calculated by dividing current assets by current liabilities. It is used to evaluate a company's ability to pay short-term obligations. Informed investors can get insights into a company's liquidity and financial health.

We will connect them directly to the most appropriate investment tutors who are ready to take them from novices to making informed decisions. Individuals can learn at their own pace. Sign up on Queltex Ai for free.

| 🤖 Registration Cost | Free of Charge |

| 💰 Financial Charges | No Additional Charges |

| 📋 Registration | Quick and Straightforward Process |

| 📊 Education Opportunities | Crypto, Mutual Funds, Forex, Stocks |

| 🌎 Supported Countries | Available Worldwide, Excluding the USA |